Business Model Innovation

In today’s economy, competition seemingly can come from anywhere. Pressure on costs is relentless, but cost advantages based on labor or materials are fleeting. Budgets are tight and most companies are striving for top-line growth.

As a result, the ability to innovate effectively and repeatedly is becoming an increasingly important source of competitive advantage. But what kind of innovation? Firms often focus on product innovation, yet new product development is costly and success is uncertain — no matter how carefully you study buyer preferences. Furthermore, successful new products are quickly mimicked — often by competitors with lower cost structures, who have not had to finance progress along the production or marketing learning curves.

A new business model, on the other hand, can take longer to duplicate and requires competitors to acquire or develop the assets and capabilities that a new model requires. A different business model changes the “rules of the game” and may enable small companies (or new entrants) to overtake large incumbents. Finally, business model innovation is a more reliable value generator than product innovation. As Bob Higgins of Highland Capital Partners put it: “I think historically where we [venture capitalists] fail is when we back technology. Where we succeed is when we back new business models.”

What is a “Business Model”?

The term “business model” is often used but rarely defined; it should describe how value is generated, harvested, and distributed. To get at this, we define Business Model simply as “who pays whom for what, how value is delivered, and why.” Taking each of these in turn:

- “Who and whom” – includes customers, intermediaries and companies (in the supply chain, for example)

- “Pays” – indicates how value is exchanged — and can be non-cash

- “For what” – outlines what value is exchanged for payment and can include physical objects as well as services or delivery standards

- “How” – specifies how the products or services are sourced and developed and how they are delivered to customers

- “Why” – outlines the key assumptions and beliefs underpinning the business model’s ability to deliver value (why will it succeed?)

Business models tend to stabilize in mature industries — until new entrants, sometimes disruptive startups, seek market share. But why leave business model innovation to the start-ups? We help both young and established companies find new ways to “go to market” — exploiting products, assets and capabilities they already have (or can readily assemble). We help our clients to:

- Recognize their current capabilities (even those not fully exploited) and business models, and determine how they generate value

- Identify new business capabilities which can be assembled with current or easily-available assets

- Devise new business models (and value propositions, if appropriate); evaluate them, and select which model(s) to pursue

- Develop the organization (if necessary) and processes required to execute the new business model(s)

Industries experiencing rapid change (especially in technologies, costs, regulatory regimes) present opportunities for business model innovation. For example, healthcare providers today are facing new technologies, higher costs, and a radical regulatory transformation (i.e., the ACA) of the ways they are paid and for what.

Example: Business Model Innovation to Enable Clinical Data Valuation & Monetization

Hospitals, clinics, and medical practices generate growing volumes of clinical data (an asset), increasingly captured in electronic medical records, yet many of these organizations are only beginning to consider systematically governing their clinical data or developing new data-enabled revenue streams — which may require new business models. Only recently have some hospitals grasped the medical and commercial potential in controlling their own clinical data and analytics — potential which was apparent several years ago from the perspective of new business models.

Our experts can help you: establish a thorough decision process, devise a data monetization strategy, and prepare and execute the strategy — leading to new sources of revenue, and avoiding preventable risks.

We can help you:

- Understand the risks and complexities involved in sharing or monetizing clinical data

- Establish new revenue streams based on licensing of data you possess already (or can easily acquire)

- Develop new services (for patients, suppliers, providers, payers) using your data to create value for others — which you can share in, with appropriate business models

- Negotiate more effectively with suppliers, providers, and payers

- Avoid being taken advantage of by HIT vendors, suppliers, providers, or even other hospitals

For more information, click here.

Client Engagement Examples

Innovation & Business Model Development

This international technology company, historically known for its innovative offerings, found itself stagnating in its core markets. Endowed with substantial corporate funding each year, their Labs (R&D) organization invented numerous new products, only to have them languish internally without being embraced by their business units (some of which were very similar to those successfully introduced by competitors – years later).

SOLUTION:

We worked with their R&D group to:

- Develop a portfolio structure to focus their innovation efforts on the specific areas that aligned the organization’s capabilities with the company’s strategic goals and specific business unit priorities

- Establish the process by which new R&D efforts are funded, prioritized and initiated — to better reflect the needs and interests of the business units

- Restructure the R&D organization — aligned with the new portfolio approach — and re-formulate the teams with the necessary skill-sets

RESULT:

Reframing the “who pays for what” to ensure that the business units “sponsored” projects in particular portfolios raised the adoption rate from 7% to 75%. This model has been replicated throughout the company’s business units for their BU-specific innovation efforts, and the company has resumed its place as a leader in their market.

Market Entry with a breakthrough technology

This $1b division of a global manufacturer had developed a new technology which had the potential to provide future competitive advantage. However, it could also undermine margins in its existing businesses. The team was struggling to bring the technology to market, and — as costs mounted — patience from the executive suite was running short.

SOLUTION:

We worked closely with both the senior executives and the business team responsible for commercializing the new technology, to:

- Analyze the market and its competitive dynamics, and then identify new business model opportunities — specifically, to sell individual components of the new technology instead of a complete power generation system

- Help them realize that the technology was better suited to be a part of a different product, in an application for customer segments that they didn’t usually serve

- Redirect their sales and marketing efforts as well as manufacturing outputs on these newly targeted customers and applications

RESULT:

The emerging business unit won renewed commitment and confidence from the executive team — and due to this business model reframing they soon won an $8MM contract to supply a vendor of specialized military products to the government.

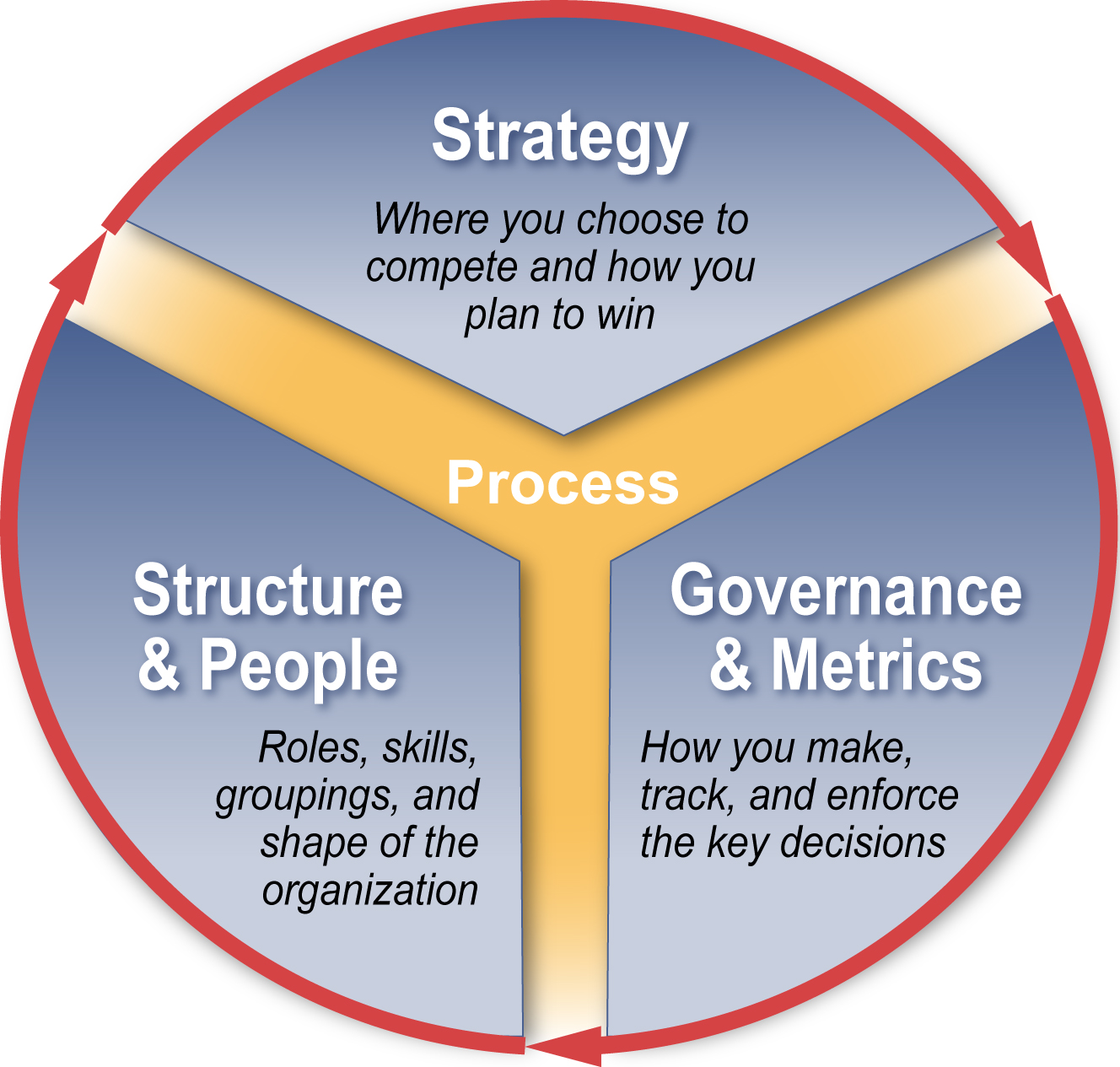

Any of these elements may need to change due to new competitors, changed regulations, different input costs, new technologies, or any of the other myriad ways the business environment is continuously evolving. That doesn’t mean they all must change or that they must change together — successful companies carefully evolve as the environment changes, and we can enter in any of these practice areas to begin to make improvements.

We employ distinctive techniques (such as business wargaming and organizational simulations) across all our practice areas, as well as proprietary frameworks and processes.