by eos consulting | Mar 22, 2021 | Manufacturing

Many manufacturers are facing booming demand as the global pandemic recedes. But fulfilling orders to meet this growing demand is often challenging because of ongoing supply chain disruptions, especially of critical components.

When capacity is limited, even temporarily, how should manufacturers think about which orders get priority? Obviously you must meet contractual obligations first — but beyond that?

In this post we propose a way to approach this analytically. There are three dimensions to consider:

- Who is the customer and how do they fit in your strategic priorities?

- Can your organization make and deliver the order within (or close to) the customer’s window?

- Should the comparative profitability of orders be a consideration?

Who Is the Customer?

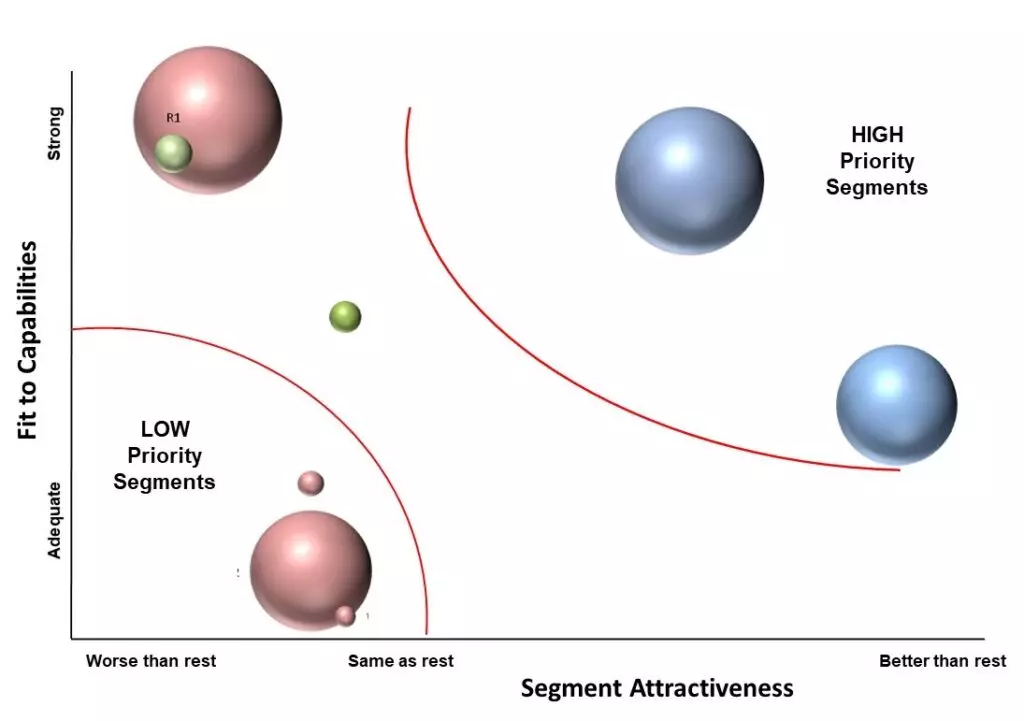

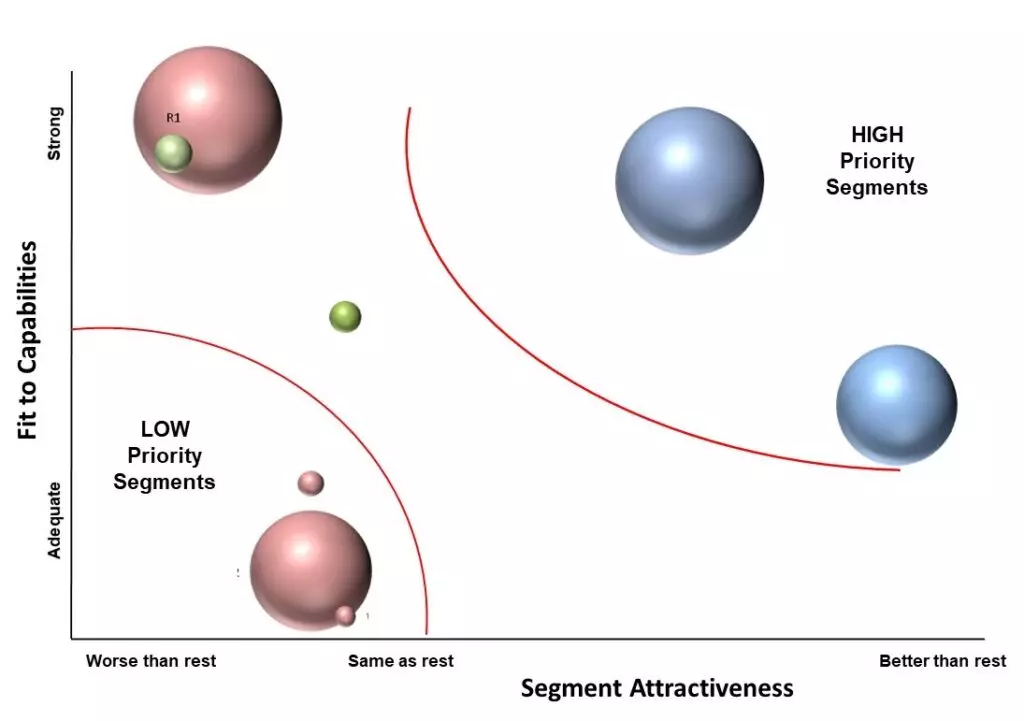

One way to prioritize by customer is to refer to the customer segmentation and prioritization of the segments — which should have been set by the leadership team of the business as a whole. Orders from customers in high-priority segments should be prioritized over orders from customers in lower-priority segments, all else being equal (which it rarely is; see additional factors below). Segmentation and prioritization of customers is a critical element in deciding where to compete and how to win.

Priority segments may be smaller but faster-growing than larger, mature segments; and allocating production to customers in such segments when industry capacity is stretched may enable you to take market share. Moreover, growth segments may have “longer legs” and should be nurtured for the future health of the business.

But an intervening consideration is the loyalty of longtime customers — shouldn’t customers who have stuck with you receive higher priority? Of course — assuming there has been reciprocity in the relationship over time. For example, if you’ve been a secondary supplier for a long time to a customer who has given you orders even when they might do better by consolidating your volume with their primary supplier, well, this could be the chance you’ve been waiting for to get a larger share of their business. Of course, many such relationships will be in high-priority segments to begin with, as most companies are willing to invest to maintain backup supplier status only in businesses they are trying to grow. Another form of customer loyalty is their demonstrated willingness to work with you to get through tough spots — for example, will they expedite PPAP loops so alternative assembly lines may be used? Flexible, pragmatic customers should get extra consideration.

Ability to Make & Deliver

In combination with customer prioritization, it’s necessary to consider whether the order can be completed without painful delays. If you can’t manufacture the entire order with materials on hand, consider the risk that you won’t be able to get everything needed. If capacity is limited because of supply chain disruptions, it’s dangerous to assume that JIT supply chains are operating as usual. (The auto manufacturers, for example, cut orders to chipmakers in the first half of 2020, then couldn’t get that capacity back once it had been allocated to higher-margin consumer products. The resulting parts shortages have forced many auto makers to pause production.)

However, it’s the delivery aspect that sometimes gets overlooked: it does little good to manufacture the order if you are unable to deliver it as expected to the customer (unless you can invoice at the factory gate). Ocean shipping has been a particular bottleneck.

By considering together both customer priority and ability to make and deliver, you can arrive at a practical (initial) prioritization of orders. It may be better to complete orders for a somewhat lower-priority customer than to be unable to deliver completed orders to a higher-priority customer.

Comparative Profitability

Only after considering both the customer and the ability to make and deliver should manufacturers take the profitability of orders into account. Although it’s tempting to put comparative profitability first, that can be strategically shortsighted — it can be better for the long-term health of the business to fulfill less profitable orders for higher-priority customers (e.g., those to whom you are a tertiary supplier, but in an attractive segment you’ve targeted for taking share) than more profitable orders for lower-priority customers, or orders you can manufacture but not get to the customer.

As an experienced manufacturing leader who had been through many business cycles told us, it’s most important to have a plan for when commitments outstrip capacity — “that’s not the time to have a production supervisor prioritizing who gets what, when. If you have to ration capacity or reorder priorities, it should be done with a script and a process that can be defended.”

Manufacturers of large capital equipment (such as bulldozers, locomotives, tractors) often promise “slots” in the production schedule to particular orders — often in return for ordering with plenty of lead time, or for selecting certain options. It’s risky to change the schedule without being open about it, but the degree of risk depends on what you committed and how transparent you were in the first place. Customers are generally more concerned with the timing of their order than with their place in the production schedule, but if you committed to a place, you should break that commitment only reluctantly. (What do you think? Please weigh in with a comment.)

In addition to prioritizing the orders you get, there are several ways to shape the demand (and resulting orders) to better suit your capacity to deliver. We’ll address those in our next article.

by eos consulting | Mar 3, 2021 | Manufacturing

It’s widely accepted that for traditional manufacturing leaders to continue to thrive, they need to become solution providers — not solely product manufacturers. They must seize the high ground of emerging information, communication and analytical capabilities embodied in the “internet of things,” and incorporate the necessary hardware and software into their products. They must re-think how they respond to customer needs, fully align all product organizations around addressing these needs, and change the way they define development programs and allocate R&D dollars. In particular, they need to:

- align priorities across product groups and regional organizations, both across and within the customer’s production assets;

- understand the customer’s production economics;

- and then employ data and analytics to identify not just product improvements, but process improvements for customers.

This reorientation represents a fundamental change in the how to win of strategy, as well as the where to compete.

But implementing this strategic change is difficult if the company is organized around its products, rather than its customers and their tasks — and the challenges begin with how the company is organized and operated.

For long-established manufacturers, most product development is traditionally performed within distinct product-based organizations — for understandable reasons. But having those groups individually prioritize all R&D for their products risks the over-improvement of existing product forms and makes it difficult to address customer needs that span product types.

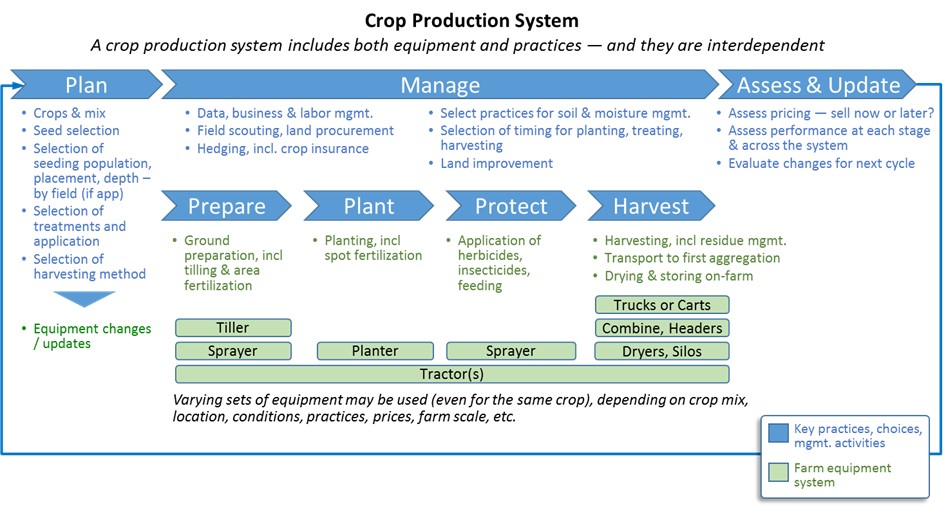

This problem becomes more acute when the company sells a collection of products to be used together in a “production system” (the full set of practices and products employed by the customer to produce a product). In industries such as road construction; airlines; mining; agriculture; building construction; or forestry (to name just a few), the range of equipment needed can be quite extensive and varied. Customers obtain their preferred equipment, consumables, and information from various suppliers who tend to specialize in each. The leading capital equipment suppliers generally seek to maximize their share of the equipment supplied for the production systems they serve, offering incentives to customers to purchase more of their equipment from them instead of assembling a heterogeneous mix. They do this with favorable financing, and increasingly by making their products work better with each other than with the products of others. But product organizations even within the same company face challenges that make it difficult to ensure their products will work together to maximize performance in the customer’s production system. This problem will only become harder as products become smarter and more connected, and the information layer spanning production systems becomes thicker, broader, and more valuable.

Organization by product presents several challenges to a strategy shift to solutions:

First: Within a single supplier, as each product organization prioritizes developing the features and capabilities that most improve their products’ performance (and their organization’s financial performance), it becomes difficult to coordinate across product organizations to deliver integrated capabilities to customers.

For example, in agriculture, consider a production system for a particular crop. Tractors, planters and combine harvesters are required equipment (among other things). The tractors and planters may be high priorities for the tractor and planter organizations, but the market for the harvesting equipment best suited to that crop may not be sufficiently attractive to the harvesting organization for them to fund development ahead of pressing needs for another crop. This disadvantages dealers as they seek to grow their share of customers’ spending, and leaves openings for competitors to exploit. Absent a way of prioritizing particular crop production systems and then picking where within them you will compete, important choices are made by default and not on purpose.

Second: Having each product group prioritize their own projects risks missing emerging customer needs. Indeed, some customers’ most important needs can only be seen by companies looking to innovate across the entire production system, decomposed into the many “jobs” that a customer needs to accomplish. For example, in agriculture, seed selection with precision planting may bring the greatest value to the customer, but it can be difficult to justify investments in those if you must take the funding from the larger product forms (e.g., tractors and harvesting combines) which generate more margin for the company.

Third: Focusing R&D on individual product forms which together make up (the equipment portion of) the customer’s production system also makes it more difficult to realize the full value of smart, connected products (see Porter & Heppelmann, HBR Nov 2014) — because typically there is no reward within one product organization for absorbing costs when the value is mostly realized by another product organization. For example: sensing and data collection (related more to production system performance than combine performance) are difficult to justify in the context of funding a combine project, especially if the benefits accrue to another organization (e.g., precision planters). Product organizations are more likely to invest instead in the features and capabilities of immediate interest to their higher-margin, most advanced customers — thus falling prey to “the innovator’s dilemma.” Additionally, much of the benefit of Big Data will be realized by changing practices in the customer’s production system (e.g., timing, inputs, processes). Seeding and feeding practices may have large effects on costs and productivity — yet may not necessarily require different equipment, but rather data collection and analysis. Equipment manufacturers who neglect such opportunities risk becoming marginalized.

John Deere recognized the risk, and began the strategic shift to being a “Smart Industrial.” As part of that shift they introduced a new operating model — organized around production systems; the technology stack; and lifecycle solutions. Deere’s reorganization has been extensive, because leadership recognizes the value of organizing to deliver the business strategy.

#manufacturingstrategy #orgstructure #strategy

by eos consulting | Feb 22, 2021 | Manufacturing Strategy, Uncategorized

If you Google manufacturing strategy, one of the top results is a Harvard Business Review article — from 1994. How can it rank so high given its vintage? The reason: it gets clicked on a lot — not only because it was written by two authorities on the subject, but because its insights remain on-point and highly useful (even after twenty-five years).

Let’s start with what they say about manufacturing strategy and strategic flexibility. Hayes & Pisano argue that:

In a stable environment, competitive strategy is about staking out a position, and manufacturing strategy focuses on getting better at the things necessary to defend that position. In turbulent environments, however, the goal of strategy becomes strategic flexibility. Being world-class is not enough; a company also has to have the capability to switch gears—from, for example, rapid product development to low cost—relatively quickly and with minimal resources. The job of manufacturing is to provide that capability.

That seems like kind of a big ask, doesn’t it? Perhaps it’s less daunting if we break it down into manufacturing capabilities that can deliver strategic flexibility to the business, such as:

- Agility & Responsiveness — the ability to handle changes in production volumes or product mixes; and to react quickly and effectively to product design changes, raw material changes, or customer order and delivery requirements (product options, order changes, delivery modes / timing / locations)

- Resilience — the ability to withstand shocks or rapid changes in exchange rates, labor or input costs, trade conditions, shipping rates, pandemics, and other operational disruptions

- Integration — the ability to incorporate new processes, products, or product architectures into the manufacturing operation

- Innovation — the ability to develop and deploy new or unique manufacturing processes to dramatically improve manufacturing performance

- Control & Improvement — the ability to direct and regulate operating processes, correct errors or inefficiencies, and to improve manufacturing performance

Such capabilities depend on much more than manufacturing sites, equipment and technology. As Hayes and Pisano point out, “a company’s capabilities are more than its physical assets. In fact, they are largely embodied in the collective skills and knowledge of its people and the organizational procedures that shape the way employees interact.”

Assembling the right combinations of assets, people, and process to deliver a desired capability — such as resilience to trade disruptions or global pandemics — takes time, commitment, and judgment.

And of course there are tradeoffs: low-cost production which relies on offshore suppliers can be brittle, subject to supply shocks (as many learned during the pandemic); yet steps to increase resilience can also increase costs. Production agility, if achieved with highly flexible lines, can also be expensive (but there are other ways to do it…).

These choices should be made in view of the business strategy — particularly the “how to win” elements. And good decisions about how to win can’t be made in ignorance of the actual or potential capabilities of the manufacturing organization. In fact, by “expanding the range of their manufacturing capabilities, [manufacturing leaders] increase their strategic options” for the business.

Which is why manufacturing leadership should be engaged in the business strategy.

by eos consulting | Oct 14, 2020 | Manufacturing, Uncategorized

Consumer and medical goods shortages during the global pandemic have inspired some media backlash against Lean Manufacturing practices; the Wall Street Journal even published an article saying we should “blame lean manufacturing” for paper towel shortages. Yet most manufacturing leaders have been taught (or learned the hard way) to “buffer or suffer” — that is, carry some inventory of key parts or materials, lest production halt for a simple stock-out. But inventory buffers are costly, and more than just the cost of capital: there’s also storage space and the risk of damage or obsolescence.

Demand or supply shocks are particularly challenging to process manufacturing (paper, paint, etc.), because winning in such products generally requires scale — often huge scale, expensive and time-consuming to build. But discrete manufacturing is vulnerable as well, especially if capacity (robots, material handling automation, assembly lines) is expensive.

This WSJ article provoked responses from Lean experts and practitioners, chiefly that:

- Lean practices work best with steady (or predictable, or controllable) demand, and that the pandemic created surges in demand that predictably created shortages; and

- Over the full cycle, Lean Practices (as demonstrated by Toyota) save much more than they cost.

The critics complain that producers are unwilling (or unable) to quickly add capacity when demand surges, and the rest of the supply chain is insufficiently buffered against demand (or supply) shocks. This restraint is attributed to the high cost and time required to add capacity (especially in process industries), but it also reflects managers having learned their lessons while playing the “Beer Game” in business school. The Beer Game is an exercise wherein teams of four (representing the factory, distributor, wholesaler, and retailer) compete to deliver beer to their customers at the lowest total cost over the course of the game (both stockouts and excess inventory incur penalties). End consumer demand is steady throughout the first part of the game, then doubles for the remainder. Inevitably, that single step change in demand generates a huge over-response in the system. Players learn that the best way to avoid “whiplash” in the Beer Game is to be slow to react to demand shocks.

So it is not surprising that many goods (including medical PPE and more) are still in short supply, even nine months into the pandemic. So, is there anything to be done, any adjustments that can be made? How should business leaders decide whether to stay (or become) lean, or instead build in more buffers to cushion against shocks? And how far should you go? The answer lies in your business strategy, which should drive your manufacturing strategy.

It starts with your value proposition — why your customers buy from you instead of your competitors. This is a key element of any business strategy. Generically, firms compete on the basis of price, differentiation, or customer intimacy.

Price includes not just cost to the customer, but also terms and transaction costs. To be sustainable, competing on price requires a secure cost advantage. Differentiation can include product quality (such as materials, durability, reliability), features, and performance. The value of the brand (where it means something to buyers) is also an element of differentiation, as is local production – really anything that a customer values and sets you apart from the competition. Customer intimacy is about the relationship, support, and responsiveness; it can include product scope, range, and customization; as well as order windows and delivery policies. (Customer intimacy can also be thought of as a dimension of differentiation.)

Customers don’t select one or another so much as they make tradeoffs between them: e.g., “good enough” quality at a “low enough” price, with adequate delivery performance. Moreover, not all customers make the same tradeoffs — although customers in particular segments may make similar tradeoffs.

If your most important customer segments will trade off the lowest possible price in return for product availability and reliability of delivery, then you should consider taking on the added costs of buffering finished goods and/or critical inputs. But if your targeted customer segments instead value the lowest price more than product availability (perhaps they prefer to hold their own inventory), then it’s worth risking occasional shortages to keep your operations as lean and efficient as possible. (In either case, you need to consider what your competitors can do for those customers — if they can accommodate those customer needs better than you, you’ll need to shift the basis of competition.)

Another way of handling these tradeoffs is to build flexibility into your sourcing and manufacturing, not by buffering but by configuring your operations to flex with supply or demand shocks. In the simplest case, lean methodology has always insisted on the need to identify and qualify additional suppliers — and many firms always source from one or two alternate suppliers as well as their primary, to ensure additional supply is available. But some disruptions (like hurricanes or pandemics) affect all regional suppliers, not just one.

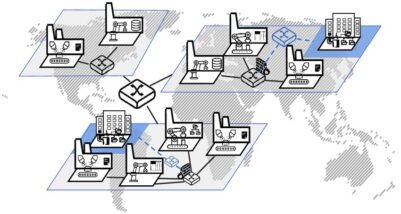

You can also build flexibility into your manufacturing network, especially if you have modularized product designs (products consisting of assemblies of interchangeable modules), by:

- Manufacturing modules in more than one location, so production in one location can cover for outages or cost surges in another

- Ensuring those manufacturing capabilities are in differing trade zones and supply bases

- Carrying some additional production capacity in those locations

Modular product designs enable you to offer more product variety, by offering different permutations of modules — which can also help limit the size and scope of inventory buffers.

Lastly, it need not be entirely up to manufacturing to respond to demand shifts: demand can be shaped to better fit manufacturing capacity. Makers of large capital equipment, for example, often offer discounts for early orders, or price options consistent with the availability of parts to make them.

Lean practices have attracted scrutiny as a result of the disruptions caused by the global pandemic. But whether you should modify what you are doing — and how — depends not just on costs, but on your business strategy.

Read more: Manufacturing Strategy

Read more: Manufacturing Strategy in Today’s Volatile Trade Environment

Read more: Hitting RESTART After the Pandemic

by eos consulting | Aug 11, 2020 | Manufacturing, Uncategorized

We’ve been talking about challenges for incumbent manufacturers, and suggested in our last post that for manufacturers to thrive, they need to command privileged positions in at least some of the business ecosystems in which they participate.

A privileged position means:

- Being core to or at the center of the ecosystem; or

- Owning vital elements of the ecosystem (standards, technology, proprietary software, etc.)

We suggested some ways to achieve that, among them:

- Ensuring that if there’s value in making your product ‘smart’, you play an important role in doing that — controlling or influencing the development of software, APIs, capabilities, standards, etc.

- If your product has software in it, owning its design and development as much as possible, especially for controls.

But designing and developing software poses distinct challenges for incumbent manufacturers — even if they don’t try to do it themselves.

In particular, incumbents’ existing development processes for many industrial products (such as electro-mechanical devices ranging from valves to combine harvesters) are likely much slower than for software & electronics — and for good reason. Such products (especially large ones) often comprise multiple integrated systems and components. Changing one affects others, and can have unpredictable effects on the performance of the entire machine. Moreover, a design change means changing manufactured parts and/or their fabrication — which, especially if it involves suppliers, can be slow, risky, and costly. Accordingly, incumbent manufacturers have learned how to update their products carefully and with manageable pacing.

Software development cycles, on the other hand, are much shorter. Software is easier to edit, test and replicate (even if the consequences are just as unpredictable, if not more so). But precisely because it is easier to edit, software development processes have come to be dominated by modularity, agile methodology, and rapid development and deployment.

Harmonizing these differing development processes across a set of design projects for a specific product is not easy, even (or especially) if the software development is outsourced. Except in cases of an entirely new product form, the physical product exists already, and the software project is about adding or upgrading sensors; adding communications in or out (from those sensors, for example); or automating (and/or optimizing) controls. Hardware engineers do not generally write software, so the first challenge is setting and maintaining execution schedules between hardware and software engineering teams (coordination only between individual engineers is often insufficient). A technical surprise or a shift in funding priorities can disrupt timelines, leading (in the worst case) to product delays or even incomplete (or buggy) solutions coming to market. In addition, design changes to the physical product and the software can get out of sync, again requiring time and often-scarce resources to reconcile. (Your software people may be spread thinner than you realize — especially if they must work with several product families.)

But there’s a deeper issue which may produce or exacerbate execution challenges: it’s not uncommon for requirements to change (or to be too vague), leading to misalignment between hardware and software teams. This especially plagues projects where the software component is outsourced or developed by a different unit of the company. It may even be unclear who owns the user experience, or the entire solution’s architecture and requirements.

In addition to adding cost, time delays are a frequent outcome of these challenges; yet for a large industrial product, missing a competitive product upgrade cycle (or two!) can be fatal to market share and/or profit margin.

So, what can be done?

- Start upstream from execution, with a shared vision across hardware and software of the value proposition for what you’re doing. Are you adding software-enabled features because the competition has them, and you must keep up? Ask yourself what the new capabilities will do for the customer, and whether/how that fits into your value proposition. If you must catch up, you might as well leapfrog — but only so far as you are meeting a real customer need, and not just trying to “out spec” the competition. (Yet leapfrogging can be a dangerous temptation — you are likely to take on additional technical risk, as well as marketing / channel challenges. And you had better be confident about profitability.)

- Ensure the product requirements are specific, measurable, and deliver the value proposition. Work together and be willing to listen to each other — often, the software team can suggest capabilities the hardware team didn’t realize were feasible. Most important, when requirements change (as they often will over the course of a project), don’t assume everybody is aware. Revisit the timeline and collaboratively make any needed adjustments.

- Consider developing a realistic, actionable product roadmap, incorporating some high-probability variants (e.g., funding cuts). This can align expectations and enable planning for contingencies. Perhaps most important, it enables you to be proactive — not re And the roadmap needs to reflect — and reconcile — the differing challenges of hardware and software development (e.g., seasonal product testing).

- Establish program governance across all the participating organizations for the set of projects together delivering the product update. This doesn’t have to be extensive or bureaucratic, but it does need to include:

-

- A joint repository of the project documents, including staffing, leadership, schedules, and requirements.

- Who decides what, and how conflicts are managed (“decision rights” — especially over product architecture, standards, and shared systems). And not just in theory — the organization must honor the process and “walk the talk,” especially when it comes to balancing the interests of not only hardware and software, but of design, manufacturing, and sales & marketing. (For example, who owns the specifications of the CAN bus on a vehicle? Especially if it is the factory which must carry the cost of a better one?)

- How communications between software and hardware teams will happen (e.g., when software teams change delivery dates for product features, how they will ensure the hardware teams know about it so they can plan).

Incorporating intelligence and connectivity into industrial products and components can be challenging, but it also opens new opportunities (as well as challenges) for incumbent manufacturers. Failing to do so can mean eventual relegation to commodity status. The manufacturing companies that will thrive in the future are likely to be “smart industrials.”

For more about operational governance, please see here.